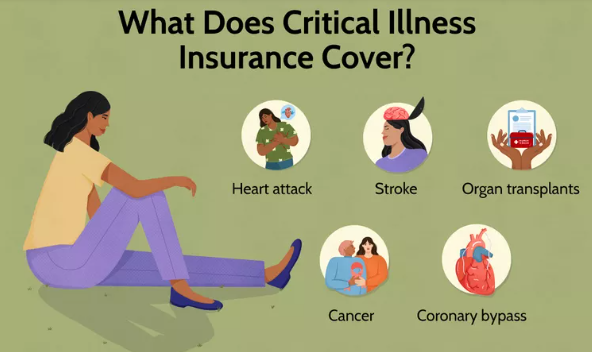

Understanding Critical Illness Insurance: A Shield Against Health Challenges

What is Critical Illness Insurance? Critical Illness Insurance is a specialized form of coverage designed to provide a lump-sum payment to policyholders who are diagnosed with a covered critical illness. Unlike traditional health insurance, which typically covers medical expenses, Critical Illness Insurance offers a financial payout that can be used to cover various costs associated … Read more