In the dynamic landscape of business operations, managing human resources comes with its own set of challenges and potential liabilities. Employment Practices Liability Insurance (EPLI) serves as a crucial shield, offering financial protection to businesses facing claims related to employment practices. In this comprehensive guide, we will explore the significance of EPLI, its key components, the types of claims covered, and considerations for obtaining comprehensive coverage. Let’s delve into the realm of Employment Practices Liability Insurance to understand how it safeguards businesses against HR-related claims.

Understanding Employment Practices Liability Insurance

What is Employment Practices Liability Insurance?

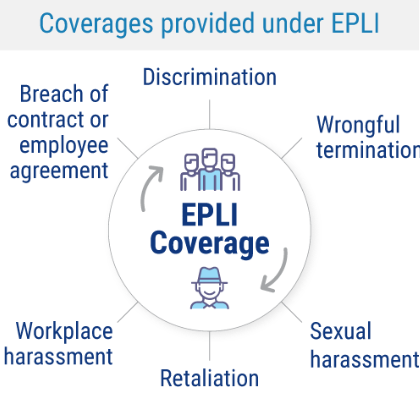

Employment Practices Liability Insurance (EPLI) is a specialized form of insurance designed to protect businesses from the financial consequences of employment-related claims. These claims can arise from various employment practices, including but not limited to wrongful termination, discrimination, harassment, and violations of employment laws. EPLI provides coverage for legal fees, settlements, and other costs associated with defending against or resolving such claims.

Key Components of Employment Practices Liability Insurance

Coverage for Various Employment Practices Claims:

EPLI typically covers a range of claims, including wrongful termination, discrimination (based on factors such as age, gender, race, or disability), sexual harassment, retaliation, and other violations of employment laws.

Legal Defense Costs:

The insurance provides coverage for legal defense costs, including attorney fees, court costs, and settlements or judgments resulting from covered claims.

Third-Party Liability:

Some EPLI policies extend coverage to claims brought by non-employees, such as customers, clients, or vendors, who allege employment-related wrongdoing.

Flexible Coverage Limits:

Businesses can choose coverage limits based on their perceived risks and financial considerations. Higher coverage limits provide more extensive protection but may come with higher premiums.

Tailored Policies:

EPLI policies can be tailored to the specific needs and risks of a business. This customization ensures that coverage aligns with the unique challenges and practices of the organization.

Risk Management Assistance:

Some insurers offer risk management services to help businesses implement practices that can reduce the likelihood of employment-related claims. This may include training programs, policy reviews, and compliance assistance.

Types of Claims Covered by Employment Practices Liability Insurance

EPLI provides coverage for a broad spectrum of employment-related claims. Common types of claims covered include:

Wrongful Termination:

Claims arising from allegations of unjust termination or dismissal, often based on discrimination, retaliation, or violation of employment contracts.

Discrimination:

Coverage for claims alleging discrimination in employment practices based on protected characteristics such as age, gender, race, religion, or disability.

Sexual Harassment:

Protection against claims of sexual harassment in the workplace, including unwelcome advances, offensive comments, or creating a hostile work environment.

Retaliation:

Claims that an employee suffered adverse actions in retaliation for engaging in protected activities, such as reporting discrimination or harassment.

Defamation:

Coverage for claims related to damaging statements made about an employee, which can harm their reputation.

Failure to Promote:

Protection against claims alleging that an employee was unfairly passed over for a promotion, often based on discriminatory practices.

Invasion of Privacy:

Claims related to violations of an employee’s privacy rights, such as unauthorized surveillance or disclosure of private information.

Breach of Employment Contract:

Coverage for claims asserting that the employer violated the terms of an employment contract.

Considerations for Obtaining Comprehensive EPLI Coverage

Assessing Business Risks

Before obtaining Employment Practices Liability Insurance, businesses should assess their specific risks. Factors such as the size of the workforce, industry, geographic location, and past employment practices should be considered to determine the appropriate level of coverage.

Evaluating Coverage Limits

The amount of coverage needed varies based on the potential risks and financial considerations of the business. Businesses should carefully evaluate coverage limits to ensure that they provide adequate protection against potential legal costs and settlements.

Tailoring Policies to Business Needs

EPLI policies can be tailored to the unique needs of a business. This customization ensures that coverage aligns with the specific employment practices, industry regulations, and risk factors associated with the organization.

Considering Deductibles

Businesses should consider the deductible amount associated with EPLI policies. The deductible is the amount the insured is responsible for before the insurance coverage kicks in. Choosing an appropriate deductible helps manage premium costs.

Reviewing Exclusions and Limitations

EPLI policies may have exclusions and limitations. It’s crucial for businesses to carefully review these aspects to understand any conditions or circumstances that may not be covered. Common exclusions may include intentional illegal acts or contractual breaches not related to employment practices.

Seeking Legal Counsel

Navigating the complexities of employment-related claims often requires legal expertise. Businesses should consider seeking legal counsel to ensure that their employment practices are in compliance with relevant laws and regulations. Legal guidance can also help businesses understand the potential risks they face and make informed decisions about obtaining EPLI coverage.

The Role of EPLI in Protecting Business Assets

Safeguarding Financial Stability

EPLI plays a vital role in safeguarding the financial stability of businesses. Legal defense costs and potential settlements resulting from employment-related claims can be substantial. EPLI ensures that businesses can navigate these challenges without compromising their financial health.

Protecting Reputational Capital

Employment-related claims can have a significant impact on a business’s reputation. EPLI not only provides financial protection but also helps in managing and mitigating reputational risks. It allows businesses to address claims in a manner that aligns with their values and commitment to fair employment practices.

Attracting and Retaining Talent

Having EPLI coverage sends a positive signal to current and prospective employees. It demonstrates that the business takes employment practices seriously and is committed to addressing potential issues in a fair and responsible manner. This can contribute to attracting and retaining top talent.

Ensuring Business Continuity

Legal challenges arising from employment-related claims can disrupt normal business operations. EPLI ensures business continuity by providing the financial resources needed to address claims efficiently and minimize the impact on day-to-day operations.

A Strategic Investment in Risk Management

In the intricate landscape of business management, Employment Practices Liability Insurance emerges as a strategic investment in risk management. It offers businesses the assurance that they can navigate the complexities of employment-related claims without compromising financial stability, reputation, or operational continuity.

As businesses strive to create inclusive and fair workplaces, the inclusion of EPLI becomes a prudent decision. It reflects a commitment to responsible employment practices and a proactive approach to addressing potential challenges. In the dynamic world of human resources and workforce management, EPLI stands as a reliable partner, providing protection, guidance, and peace of mind.