What is Critical Illness Insurance?

Critical Illness Insurance is a specialized form of coverage designed to provide a lump-sum payment to policyholders who are diagnosed with a covered critical illness. Unlike traditional health insurance, which typically covers medical expenses, Critical Illness Insurance offers a financial payout that can be used to cover various costs associated with the illness, including medical treatments, ongoing care, and even non-medical expenses.

Key Features of Critical Illness Insurance

Lump-Sum Payout:

Upon diagnosis of a covered critical illness, the policyholder receives a lump-sum payment. This amount is predetermined and agreed upon when purchasing the policy.

Coverage for Specific Illnesses:

Critical Illness Insurance typically covers a predefined list of severe illnesses. Common conditions include cancer, heart attack, stroke, organ transplants, and other major medical events.

No Requirement for Medical Receipts:

Unlike traditional health insurance, which often requires policyholders to submit medical receipts for reimbursement, Critical Illness Insurance provides a lump sum without the need for detailed documentation of expenses.

Flexibility in Usage:

The payout from Critical Illness Insurance is versatile and can be used at the policyholder’s discretion. It can cover medical bills, rehabilitation costs, mortgage payments, childcare, or any other expenses deemed necessary.

Survivorship Benefit:

Some policies offer a survivorship benefit, providing a payout to the policyholder’s beneficiaries in the event of the policyholder’s death. This benefit is typically triggered if the policyholder passes away within a certain period after a critical illness diagnosis.

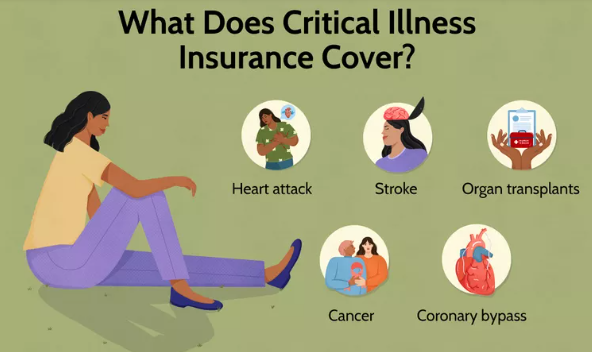

Types of Critical Illnesses Covered

Critical Illness Insurance typically covers a range of severe health conditions. While the specific illnesses covered can vary among insurance providers, common critical illnesses include:

Cancer:

Coverage for various types and stages of cancer, including but not limited to breast cancer, lung cancer, and leukemia. Payment triggered by the diagnosis of a heart attack, typically characterized by a specific set of medical criteria. Coverage for strokes, considering factors such as the severity and lasting impact on the individual’s health.

Organ Transplants:

Financial support for individuals undergoing organ transplants, such as kidney, liver, or heart transplants.

Kidney Failure:

Coverage for the diagnosis of end-stage renal failure, often requiring dialysis or transplantation.

Major Organ Failure:

Encompassing conditions where major organs, such as the heart, lungs, liver, or pancreas, fail and require significant medical intervention.

Paralysis:

Coverage triggered by the diagnosis of paralysis resulting from specific medical conditions or accidents.

Deafness or Blindness:

In some policies, coverage is extended to include permanent loss of hearing or sight.

It’s crucial for individuals considering Critical Illness Insurance to carefully review the list of covered illnesses in the policy to ensure it aligns with their health concerns and potential risks.

Considerations for Obtaining Comprehensive Coverage

Assessing Personal Health Risks

Before obtaining Critical Illness Insurance, individuals should assess their personal health risks and family medical history. Understanding the likelihood of specific critical illnesses can help in selecting a policy that provides comprehensive coverage for potential health challenges.

Reviewing Policy Exclusions and Limitations

Critical Illness Insurance policies may have exclusions and limitations. It’s essential for policyholders to carefully review these aspects to be aware of any conditions or circumstances that may not be covered. Common exclusions may include pre-existing conditions or certain lifestyle-related illnesses.

Determining Coverage Amount

The amount of coverage needed varies based on individual circumstances. Consider factors such as potential medical expenses, ongoing care costs, and non-medical expenses that might arise during a critical illness. Adequate coverage ensures that the lump sum received can sufficiently address financial needs.

Understanding Waiting Periods

Some Critical Illness Insurance policies have waiting periods before coverage takes effect. Policyholders should be aware of these waiting periods and plan accordingly. Understanding the waiting period is crucial to ensure timely financial support in the event of a critical illness diagnosis.

Evaluating Cost and Affordability

The cost of Critical Illness Insurance can vary based on factors such as age, health status, coverage amount, and policy terms. Individuals should carefully evaluate the costs associated with the policy and ensure it aligns with their budget while providing the necessary coverage.

Seeking Professional Advice

Navigating the complexities of insurance requires expertise. Seeking advice from insurance professionals or financial advisors can help individuals make informed decisions based on their unique circumstances. Professionals can provide insights into policy options, coverage terms, and potential riders that may enhance the policy.

The Role of Critical Illness Insurance in Financial Planning

Addressing Income Protection

Critical Illness Insurance plays a crucial role in income protection. A lump-sum payout can help cover living expenses, mortgage payments, and other financial obligations during the recovery period when an individual may be unable to work.

Supplementing Health Insurance

While health insurance covers medical expenses, it may not address the full spectrum of costs associated with a critical illness. Critical Illness Insurance supplements health insurance by providing funds for non-medical expenses, allowing individuals to focus on recovery without financial strain.

Providing Peace of Mind

The financial support offered by Critical Illness Insurance goes beyond covering expenses. It provides peace of mind during challenging times, allowing individuals to concentrate on their health and well-being without the added stress of financial uncertainty.

A Vital Component of Comprehensive Coverage

In the intricate landscape of insurance, Critical Illness Insurance stands out as a vital component of comprehensive coverage. It offers financial support during health crises, addressing not only medical expenses but also the broader spectrum of costs associated with severe illnesses.

As individuals navigate the decision-making process of obtaining Critical Illness Insurance, careful consideration of personal health risks, policy terms, and financial implications is paramount. The goal is to create a robust financial safety net that provides security and peace of mind in the face of health uncertainties.

In the journey of safeguarding one’s well-being and financial stability, Critical Illness Insurance emerges as a powerful ally, offering support and protection when it matters most. As individuals embark on the path of securing their future, the inclusion of Critical Illness Insurance becomes a strategic and compassionate choice, ensuring that health challenges do not translate into financial burdens.