What is a Deductible?

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in and starts covering the remaining costs. Essentially, it represents your initial financial responsibility in the event of a covered loss. Deductibles are common in various types of insurance, including auto insurance, homeowners insurance, health insurance, and more.

Why Do Deductibles Exist?

Deductibles serve several purposes within the insurance framework:

Risk Sharing:

Deductibles encourage policyholders to share in the financial responsibility for small and moderate losses. By doing so, it helps prevent overuse of insurance for minor claims.

Cost Control:

Insurance companies use deductibles as a way to control costs. When policyholders bear a portion of the initial expenses, it helps keep insurance premiums more affordable.

Differentiating Between Small and Large Losses:

Deductibles help distinguish between smaller, more frequent losses that the policyholder can handle and larger, less frequent losses where insurance becomes a crucial financial safety net.

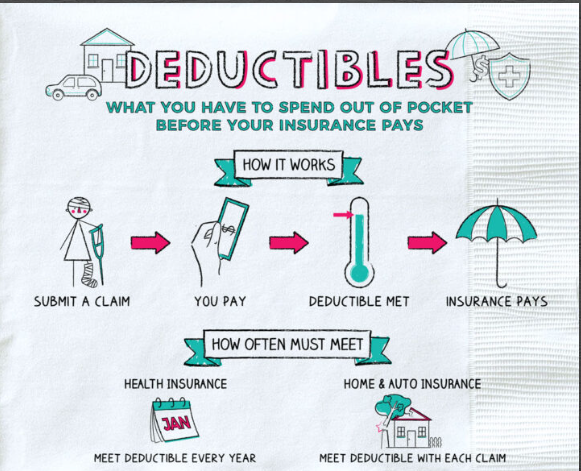

How Deductibles Work:

Let’s say you have a $500 deductible on your auto insurance policy. If you’re involved in an accident resulting in $2,000 in damages and repairs, you would pay the first $500, and the insurance company would cover the remaining $1,500. If the repair costs are below your deductible, you would be responsible for the entire amount.

Understanding Coverage Limits: The Maximum Payout

What Are Coverage Limits?

Coverage limits represent the maximum amount an insurance policy will pay for a covered loss. These limits can apply to different aspects of your insurance policy, such as property damage, liability claims, or medical expenses. Understanding your coverage limits is crucial to ensure you have adequate protection in place.

Types of Coverage Limits:

Per Occurrence Limit:

This is the maximum amount the insurance will pay for a single occurrence or claim. For example, if your auto insurance has a per occurrence limit of $100,000 for property damage, that’s the maximum the insurance will pay for damages resulting from a single accident.

Aggregate Limit:

The aggregate limit is the maximum amount the insurance will pay over a specific period, often a policy term, regardless of the number of occurrences. It’s crucial to be aware of both per occurrence and aggregate limits.

Importance of Adequate Coverage Limits:

Having sufficient coverage limits is vital to ensure that your insurance adequately protects you in various scenarios. Inadequate limits could leave you personally responsible for expenses beyond what your insurance covers. For example, if you have low liability limits on your homeowners insurance and a guest is injured on your property, you may be personally liable for medical expenses beyond your coverage limits.

Considerations for Choosing Deductibles and Coverage Limits:

Balancing Premiums and Out-of-Pocket Costs:

Higher Deductibles, Lower Premiums: Opting for a higher deductible often results in lower insurance premiums. This can be a cost-effective choice if you have the financial capacity to cover higher out-of-pocket expenses in the event of a claim.

Lower Deductibles, Higher Premiums:

Choosing a lower deductible means higher premiums, but your out-of-pocket costs will be lower when you need to file a claim. This might be preferable if you prefer more predictable and manageable costs.

Evaluating Coverage Limits:

Assessing Potential Risks:

Consider potential risks and worst-case scenarios. For liability coverage, evaluate the potential costs of legal claims. For property coverage, assess the replacement or repair costs of your assets.

Accounting for Specific Needs:

Tailor your coverage limits to your specific needs. If you own valuable assets or have significant liability risks, opting for higher coverage limits is advisable.

Regularly Reviewing Coverage:

As your financial situation and lifestyle change, it’s crucial to regularly review your insurance coverage. Adjust coverage limits and deductibles to align with your evolving needs.

Making Informed Decisions for Financial Protection

Deductibles and coverage limits are integral components of insurance policies that directly impact your financial responsibility and the extent of protection provided. Striking the right balance between premiums, deductibles, and coverage limits requires careful consideration of your financial capacity, risk tolerance, and specific needs.

By understanding how deductibles and coverage limits function, you empower yourself to make informed decisions when selecting insurance policies. Regularly reviewing and adjusting these elements ensures that your coverage remains aligned with your evolving circumstances, providing you with the financial protection you need in the face of unforeseen events.