Navigating the intricacies of Medicare is a crucial aspect of senior healthcare. This in-depth guide aims to provide seniors with a comprehensive understanding of the U.S. Medicare system, covering its different parts, enrollment processes, supplemental coverage options, and essential considerations. Let’s embark on a journey to unravel the complexities of Medicare, ensuring seniors can make informed decisions about their healthcare needs.

1. Overview of the U.S. Medicare System:

Historical Context:

Medicare, established in 1965, represents a landmark in U.S. healthcare history. Born out of a commitment to provide accessible healthcare for seniors, it has evolved to become a multifaceted program covering various aspects of medical care.

Operational Framework:

Medicare operates as a federal health insurance program primarily designed for individuals aged 65 and older. It also extends coverage to certain younger individuals with disabilities. Administered by the Centers for Medicare & Medicaid Services (CMS), the program is divided into different parts to address specific healthcare needs.

2. The Importance of Understanding Medicare:

Optimal Healthcare Coverage:

A thorough understanding of Medicare is fundamental to ensuring seniors receive optimal healthcare coverage. This knowledge empowers individuals to make informed choices about their health, allowing them to access the right services at the right time.

Addressing Concerns:

Common misconceptions and concerns about Medicare often revolve around its complexity. This section aims to address these concerns, providing clarity on eligibility, coverage limitations, and dispelling myths that may cause uncertainty among seniors.

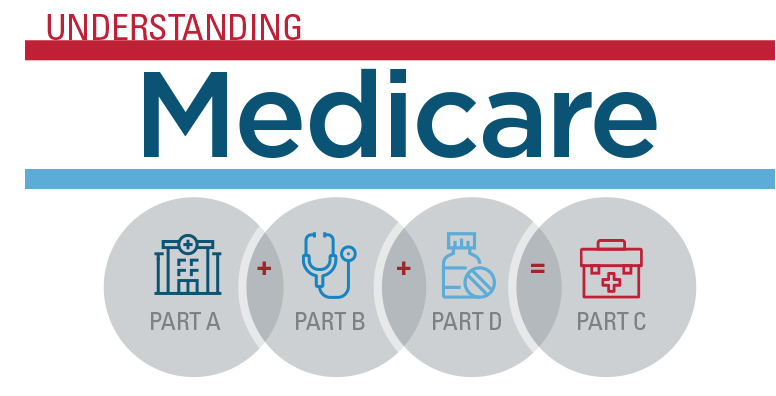

3. Breaking Down the Different Parts of Medicare:

a. Part A (Hospital Insurance):

Part A, often referred to as Hospital Insurance, covers inpatient hospital stays, hospice care, and skilled nursing facility care. Exploring the nuances of this coverage ensures seniors are aware of the medical services encompassed.

b. Part B (Medical Insurance):

Part B encompasses outpatient care, preventive services, and coverage for doctor’s visits. Understanding the breadth of medical services covered under Part B is crucial for seniors seeking comprehensive healthcare.

c. Part C (Medicare Advantage):

Medicare Advantage plans, operating under Part C, offer an alternative to Original Medicare. Private health plans often include additional benefits, such as vision and dental coverage. This section explores the advantages and considerations of opting for Medicare Advantage.

d. Part D (Prescription Drug Coverage):

Prescription drug coverage, found in Part D, is a vital component for many seniors. This section delves into standalone prescription drug plans, their coverage specifics, and the importance of medication coverage within the Medicare framework.

4. Enrollment Periods and Processes:

Understanding the various enrollment periods is crucial for seniors to ensure seamless access to Medicare benefits.

Initial Enrollment Period (IEP):

Seniors become eligible for Medicare around their 65th birthday. The Initial Enrollment Period provides a window during which individuals can enroll without penalties.

General Enrollment Period (GEP):

For those who miss their IEP, the General Enrollment Period offers another opportunity to enroll, albeit with potential penalties. This section explains the process and implications.

Special Enrollment Periods (SEPs):

Certain life events, such as moving or losing employer coverage, trigger Special Enrollment Periods. Seniors need to understand these periods to make timely adjustments to their Medicare coverage.

5. Supplemental Coverage Options:

Understanding supplemental coverage options is crucial for seniors aiming to enhance their Medicare benefits.

a. Medigap (Medicare Supplement Insurance):

Medigap policies, labeled A-N, fill gaps in Original Medicare coverage. This section explores the different plans and their coverage specifics, helping seniors choose the most suitable option.

b. Medicare Advantage Plans:

Medicare Advantage plans offer an alternative to Original Medicare, providing additional benefits. This section delves into the types of Advantage plans, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Special Needs Plans (SNPs).

6. Navigating Medigap vs. Medicare Advantage:

Comparative Analysis:

This section offers a comprehensive comparison between Medigap and Medicare Advantage. It explores the advantages, disadvantages, and considerations for seniors when choosing between these supplemental coverage options.

Decision-Making Factors:

Seniors need to consider factors such as healthcare needs, budget constraints, and personal preferences. This portion of the guide assists in the decision-making process, ensuring seniors align their choices with their unique circumstances.

7. Common Challenges and Solutions:

Seniors may encounter challenges within the Medicare framework. This section addresses these challenges and provides practical solutions.

a. Out-of-Pocket Costs:

Understanding potential out-of-pocket expenses under Medicare is crucial. Tips and strategies for managing and budgeting for these costs are outlined, ensuring seniors can navigate their healthcare expenses effectively.

b. Access to Care:

Concerns about accessing healthcare providers and specialists within the Medicare network are addressed. This section emphasizes the flexibility and choices available within the Medicare system.

8. Importance of Regular Medicare Reviews:

Encouraging seniors to conduct regular reviews of their Medicare coverage is vital for adapting to changing healthcare needs.

Life Changes and Adjustments:

Life changes, such as health status or lifestyle modifications, may necessitate adjustments to healthcare plans. This section guides seniors in assessing their evolving needs and making informed changes to their Medicare coverage.

9. Medicare and Retirement Planning:

Understanding how Medicare integrates with overall retirement planning is crucial for comprehensive financial well-being.

Strategies for Integration:

This section explores strategies for incorporating Medicare considerations into broader retirement plans, ensuring seniors align their healthcare choices with their financial goals.

10. Leveraging Preventive Services and Wellness Benefits:

Encouraging seniors to proactively engage with preventive services and wellness benefits is vital for maintaining optimal health.

Accessing Preventive Services:

An exploration of the preventive services covered by Medicare encourages seniors to leverage these offerings, contributing to a proactive and preventative approach to healthcare.

Wellness Initiatives:

Understanding wellness benefits and initiatives aimed at promoting senior health is vital. This section highlights the resources available to seniors to support their overall well-being.

This comprehensive guide serves as a roadmap for seniors navigating the Medicare landscape. By empowering them with knowledge about the different parts of Medicare, enrollment processes, supplemental coverage options, and proactive healthcare strategies, this guide aims to enhance seniors’ ability to make well-informed decisions for their health and well-being. From understanding the historical context of Medicare to navigating complex enrollment periods, seniors can use this guide as a valuable resource in their journey towards optimal healthcare coverage.