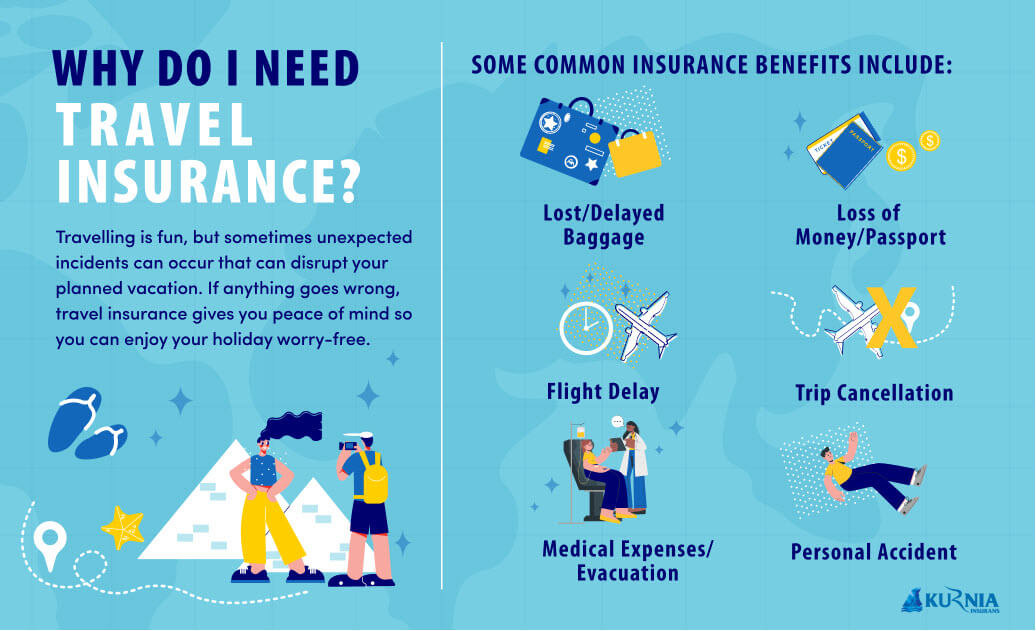

Travel insurance is a financial product designed to provide protection against unforeseen events and expenses that may occur before or during a trip. It serves as a safety net, offering coverage for a range of situations that could potentially disrupt your travel plans or lead to financial losses.

Why Travel Insurance Matters: Safeguarding Your Travel Investment

Trip Cancellation or Interruption:

Unforeseen circumstances, such as illness, family emergencies, or unexpected work commitments, can force you to cancel or cut short your trip. Travel insurance can reimburse you for non-refundable expenses like airfare, accommodation, and tour costs.

Medical Emergencies:

Falling ill or getting injured while traveling can lead to significant medical expenses. Travel insurance provides coverage for emergency medical treatment, hospital stays, and even medical evacuation if necessary.

Lost or Delayed Baggage:

Airlines may misplace or delay your luggage, leading to inconvenience and additional expenses. Travel insurance can cover the cost of essential items and clothing if your baggage is delayed, and provide reimbursement for lost belongings.

Travel Delays:

Transportation delays, such as flight cancellations or missed connections, can disrupt your travel plans. Travel insurance can offer coverage for additional expenses like meals and accommodation incurred due to such delays.

Travel Assistance Services:

Travel insurance often includes assistance services, providing support in emergencies. This can range from helping you find medical facilities to arranging for emergency transportation or legal assistance.

Coverage for Adventure Activities:

If your trip involves adventurous activities like hiking, skiing, or scuba diving, travel insurance can offer coverage for injuries or accidents related to these activities.

Financial Protection:

Travel represents a financial investment, and unforeseen events can result in financial losses. Travel insurance acts as a financial safety net, providing reimbursement for covered expenses and mitigating the impact of unexpected incidents.

Key Components of Travel Insurance: Navigating Coverage Options

Understanding the key components of travel insurance is crucial for choosing the right coverage for your specific needs. Here are the main elements to consider:

Trip Cancellation and Interruption:

This coverage reimburses you for non-refundable trip expenses if you need to cancel or cut short your trip due to covered reasons, such as illness, injury, or unforeseen emergencies.

Emergency Medical Coverage:

Covers the cost of emergency medical treatment, hospital stays, and sometimes dental care. Some policies also include coverage for medical evacuation to transport you to a suitable medical facility.

Baggage and Personal Belongings:

Provides reimbursement for lost, stolen, or damaged baggage, as well as expenses for essential items if your baggage is delayed.

Travel Delay Coverage:

Offers reimbursement for additional expenses incurred due to covered travel delays, such as accommodation and meals.

Trip Interruption:

Covers additional expenses if you need to cut short your trip and return home due to covered reasons.

Emergency Assistance Services:

Includes services such as 24/7 travel assistance, medical assistance, legal assistance, and coordination of emergency transportation.

Coverage for Adventure Activities:

If your trip involves adventure sports or activities, check if the policy provides coverage for injuries related to these activities.

Considerations for Choosing Travel Insurance: Tailoring Protection to Your Trip

When selecting travel insurance, it’s essential to tailor the coverage to align with the specifics of your trip. Consider the following factors:

Destination and Activities:

Different destinations and activities carry varying levels of risk. If you’re engaging in adventure sports or traveling to a region with specific health concerns, ensure that your insurance provides adequate coverage for these factors.

Trip Duration:

The duration of your trip can impact the type of coverage you need. Longer trips may require more comprehensive coverage, while shorter trips may have different insurance requirements.

Pre-existing Medical Conditions:

Some travel insurance policies may exclude coverage for pre-existing medical conditions. If you have such conditions, look for policies that offer coverage or consider purchasing a separate policy for medical needs.

Age and Travel Companions:

Age can affect insurance premiums, and some policies may have age restrictions. Additionally, if you’re traveling with family or companions, ensure that the policy covers everyone and provides the necessary protection for each individual.

Coverage Limits and Deductibles:

Understand the coverage limits and deductibles in the policy. Coverage limits represent the maximum amount the insurance will pay, while deductibles are the amount you must pay out of pocket before the insurance kicks in.

Exclusions and Limitations:

Familiarize yourself with the policy’s exclusions and limitations. Some common exclusions include coverage for pre-existing conditions, high-risk activities, and certain destinations.

Cancellation Reasons:

Check the covered reasons for trip cancellation. Policies vary, and understanding the specific circumstances under which you can cancel your trip and receive reimbursement is crucial.

A Comprehensive Guide to Travel Insurance

In the realm of travel, the unexpected can happen. Travel insurance serves as a reliable companion, offering protection and financial security when you need it most. Understanding the nuances of travel insurance, from its key components to considerations for choosing the right coverage, empowers you to make informed decisions and enjoy your journey with peace of mind.

Whether you’re a seasoned traveler or embarking on your first adventure, the knowledge and insights gained from this comprehensive guide will contribute to a more informed and enjoyable travel experience. Safe travels!